Billing

Paperless billing and online bill pay

Summit Health is excited to offer paperless billing. We are committed to delivering a more secure and convenient way to view your bills while reducing our environmental impact.

You will no longer receive paper statements if you have a MyChart account and have not selected a billing preference. You will be notified of new billing statements through email and the MyChart patient portal.

We’re also pleased to offer online bill pay to provide an easier way to pay your bills.

Frequently asked billing questions

General questions

Summit Health accounts representatives can answer your billing questions.

Monday – Friday

8:00 am to 4:00 pm PST

Email: mychart@bmctotalcare.com

Phone: 541-382-2811

Rates vary widely depending on your medical benefits and insurance plan. We may need to speak to you directly to determine your needs.

To start the process, either call or email:

Email: mychart@bmctotalcare.com

Phone: 541-382-2811

Please be ready to provide as much of the following information as you can: name, address, phone, procedure/service(s), CPT code (if available), insurance plan, contact info (phone number and/or email) and location of service(s), if known.

You will receive a good-faith estimate, which may include a typical range of costs for these services, within three business days.

The estimate provided will be the best based on the patient’s information. It is not a guarantee of what you will be charged.

Certain imaging and radiology services performed at Summit Health are read/interpreted by a provider at Central Oregon Radiology Associates (CORA). If your imaging service was read by CORA, expect a separate bill containing the amount due for CORA.

Now more than ever, ongoing changes with health insurance plans make it especially important to understand your coverage and know the costs you must pay when visiting your physician, having tests, and undergoing procedures. For this reason, Summit Health recommends that you learn the specifics of your plan before upcoming healthcare visits.

Your insurance plan may require multiple copays, higher deductibles, and coinsurance. Coverage will depend on the type of plan you have chosen.

You can learn your policy details by visiting your insurance company’s Web site or contacting its customer/member services department. The back of your insurance card should include the phone numbers and Web site addresses you’ll need.

Patients with active MyChart accounts will no longer receive paper bills in the mail unless they opt out of paperless billing from within their MyChart account.

Patients can log in to their MyChart patient portal and make a secure payment from within their account.

Talk with your insurer to clearly understand the details of your plan and coverage.

You also can speak with a Summit Health Patient Account Specialist or Financial Counselor Monday through Friday, 8:00 am to 4:00 pm, to discuss your concerns and ask for guidance. Call us at 541-317-4200.

To continue creating positive patient experiences, Summit Health redesigned our patient statements. Our new statements create a more user-friendly view of your balance and transactions, and you can make payments through the use of a QR code.

If you are choosing a health plan, review insurance plans and ask yourself:

- What are my options?

- Does this health plan provide the benefits and services I need?

- Does this health plan offer the clinicians and hospitals I want?

- Can I afford this health plan, including its premiums, deductibles, co-insurance, and copays?

- Will the plan cover the cost of my medications?

You can learn details about your health insurance policy, including the amount of your copay, deductible, and coinsurance by visiting your health insurance company Web site or calling its customer services department.

The back of your health insurance card should have the phone number(s) and website address(es) you need.

Before any health care visits, be sure to ask your health insurance company:

- Is my doctor’s visit covered completely? If not, how much must I pay?

- Will my tests be covered completely? If not, how much must I pay?

- If I need a procedure, including surgery, how much will my insurance cover? How much must I pay?

- Will I need authorization from my insurance company before my health care visit?

To avoid unwanted health-care billing surprises, be sure to always:

- Ask your insurance company what costs you must pay out of pocket for your doctor visit, health care visit, test, procedure, or surgery

- Bring your most up-to-date insurance card(s) to every doctor appointment and health care visit

We will accept cash payment at Eastside Clinic and Old Mill District Clinic locations only.

You can now pay your bills, see your billing statement, and manage your account after registering on our secure MyChart patient portal.

The portal will allow you to communicate with us easily, safely, and at your convenience. You can access it 24 hours a day, 7 days a week to get personal health information. This portal replaces our previous systems, but you can still access them if you want to review your data.

If you are injured in an automobile accident or at work, call your insurer first to confirm your coverage, get a claim number for the accident, and get the name of an adjuster.

For worker’s compensation, you must contact your insurer and get a claim number before seeing a doctor or having any health care services or visits.

In an emergency, please visit our Urgent Care Center or the nearest emergency department.

Summit Health offers a wide range of services to help you after an accident or injury, including:

- Expert physicians in a wide range of specialties

- A state-of-the-art laboratory

- Imaging/radiology services

- Physical therapy

Summit Health participates with most automobile insurance companies and managed care physician provider panels to help you get the high-quality medical care to which you are entitled. We also participate with most workers’ compensation insurance companies.

If you are injured in an automobile accident or at work, Summit Health can help you get comprehensive, coordinated care for your medical needs.

If you are injured in an automobile accident or at work, call your insurer first to confirm your coverage, get a claim number for the accident, and get the name of an adjuster.

For worker’s compensation, you must contact your insurer and get a claim number before seeing a doctor or having any health care services or visits.

In an emergency, please visit our Urgent Care Center or the nearest emergency department.

Summit Health offers a wide range of services to help you after an accident or injury, including:

- Expert physicians in a wide range of specialties

- A state-of-the-art laboratory

- Imaging/radiology services

- Physical therapy

Summit Health participates with most automobile insurance companies and managed care physician provider panels to help you get the high-quality medical care to which you are entitled. We also participate with most workers’ compensation insurance companies.

Please contact your Affordable Care Act (Obamacare) insurer and ask for help understanding the details of your coverage.

Two Oregon health care insurers offer plans aligned with the Affordable Care Act (also known as Obamacare): Pacific Source and Providence. Summit Health is in network for both of these plans.

Copay is the fixed amount you must pay for a covered health care service. Copays are due at the time you receive a health care service. Most often, you will be asked to deliver your copay when you check in for your doctor’s visit or diagnostic test. Copay amounts vary depending on your health insurance plan. For example, some patients will be required to copay $15 for a regular checkup, whereas other patients might have a $20 (or a lower or higher) copay for the same appointment.

Deductible is the amount you must pay for a health care service before your health insurance plan begins paying. For example, if you visit an emergency department and your deductible amount is $500, you must pay the $500 deductible amount before your insurance company will cover the remaining health care charges associated with your emergency visit. Deductibles do not always apply to all health care services. For this reason and to avoid unwanted billing surprises, you should ask your insurance company for a list of covered services.

Coinsurance refers to your share of the costs of a health care visit. Coinsurance is calculated as a percentage of the amount of a service. You are responsible for paying the full amount of your coinsurance and your deductible charge. For example, if your health insurance plan allows $100 for a health care checkup and you have paid your deductible, your coinsurance payment of 20 percent (or whatever percent applies to your insurance plan) would be $20. Your health insurance plan will pay the remaining $80 due for your visit.

Your health insurance company works with providers to agree upon a rate for a variety of health care costs. Once providers have agreements with your health insurance company, they are considered in network.

Your in-network providers can include:

- Primary care doctors, other practitioners such as certified diabetes educators, nurse practitioners, physical therapists, and specialists

- Laboratories

- Radiology and imaging centers

- Hospitals

- Pharmacies

Health care providers in your network receive full payment from your insurance company for the agreed-upon rate for your health care services. The rate your providers receive includes your insurer’s share of the cost as well as your share of the cost. Most patients pay their share of health care costs in a copayment, deductible, or coinsurance.

For example, if a visit with your primary care doctor costs $120 and your agreed-upon copay is $20, you will pay $20 at the time you visit your in-network doctor. Your insurance company will then pay the agreed-upon balance of $100.

A doctor or practitioner, specialist, hospital, pharmacy, or other health care provider or service that has no agreement with your insurance company is considered out of network.

When you get out-of-network health care and services, you are likely to be responsible for paying some, much, or all of the cost of the service. The amount you must pay for out-of-network services depends on whether your health insurance company is willing to pay part of the bill. For this reason and to avoid unwanted billing surprises, it is best to check with your health insurance company before you get any out-of-network health care services.

In some cases, your health insurance company can give you a list of comparable, in-network health care providers and services. If your health insurance company cannot offer you an in-network alternative, you can ask a representative to tell you whether your health insurance company will cover any or all of the cost of the service you need.

Having your most up-to-date card(s) at each health care visit helps ensure that we have a valid group number, a valid mailing address for claims, updates for employer group renewals, changes in personal coverage options, and information about your visit such as workers compensation or motor vehicle accident information.

Call your health insurance company immediately if your insurance card is lost or stolen!

For referrals

- If your primary care provider is with Summit Health, you are responsible for knowing whether you need a referral for a health care visit outside of Summit Health. Talk with your insurer before your health care visit to confirm whether it will be covered

- If you have a non-Summit Health primary care provider and your insurance plan requires a referral to see a Summit Health practitioner, you must contact your primary care provider to get your referral before your health care visit

For authorizations

- Authorizations are required for most services, tests, procedures, and surgeries

- When your Summit Health practitioner has ordered a service, test, procedure, or surgery for you, our authorization department will ensure you get the authorization you need; however, it is important that you follow up and confirm with your insurer and your provider that the authorization is in place before your health care visit.

If you have no medical insurance, you can speak with a Summit Health Patient Account Specialist or Financial Counselor Monday through Friday, 8:00 am to 4:00 pm and ask for guidance. Call us at 541-317-4200.

To ensure that all the services you need are authorized and reimbursed appropriately, you must notify your provider as soon as you change insurance plans to give your provider the most current information about your new plan.

Summit Health accepts Medicare, including:

- Aetna

- Pacific Source

- Providence

- Humana

- Health Net

- United Health Care

Summit Health also accepts Medicaid, including:

- Pacific Source

- Moda

We want to help you! Summit Health Patient Account Specialist and Financial Counselors can answer billing questions Monday through Friday 8 AM to 4 PM. Call us at 541-317-4200.

You also may register for our MyChart patient portal to manage your accounts, including seeing billing statements and balances and make secure credit card payments.

Paperless billing

No. Patients who don’t have a MyChart account will continue receiving paper statements. If you don’t have a MyChart account, we encourage you to sign up to experience the many benefits MyChart has to offer. Sign up for MyChart now

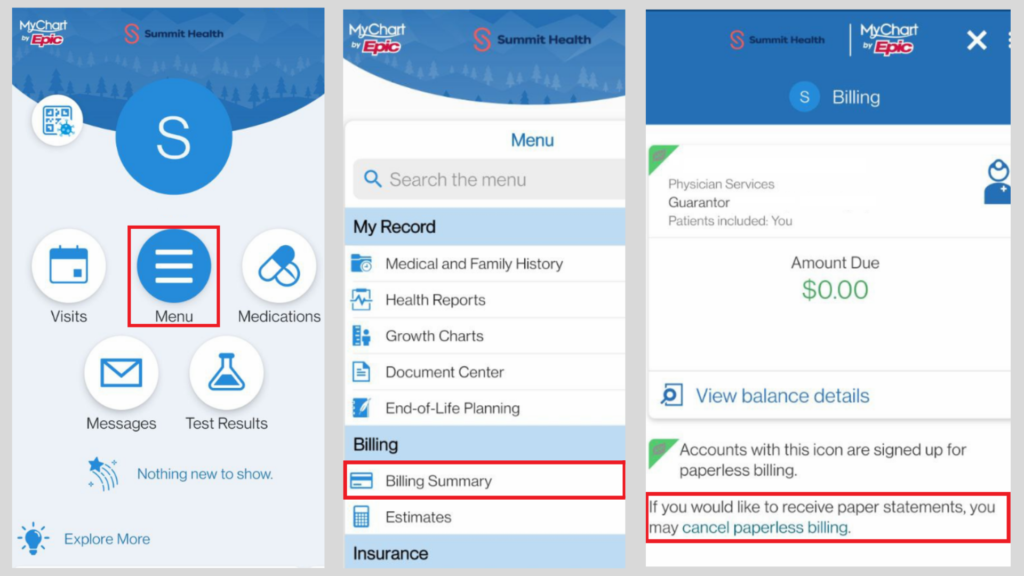

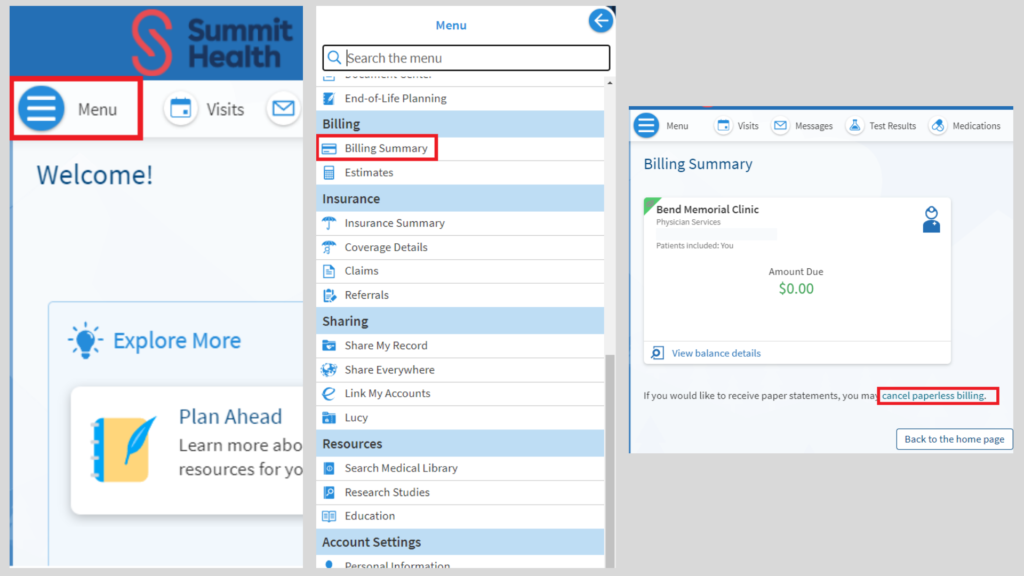

- Log in and proceed to the Menu icon.

- Scroll to the Billing tab and select Billing Summary.

- You will now be viewing current account balance. You can also choose to opt back to receiving paper statements.

- Log in and proceed to the Menu icon.

- Scroll to the Billing tab and select Billing Summary.

- You will now be viewing current account balance. You can also choose to opt back to receiving paper statements.

We understand that some patients with MyChart accounts prefer to receive a paper statement—and that’s okay! Resuming paper statements is easy. Just follow the steps above to access your billing preferences. Patients can opt in and opt out of receiving paper statements as often as they would like.

When a new statement is ready to review, you’ll receive a monthly notification to the email address on file in your MyChart account.

Billing statements are generated on a monthly cycle and are only current as of the date of the statement. Balances displayed in MyChart, however, are updated in real-time and will show any current unpaid balance.

Yes, Summit Health billing representatives can assist you with opting out. Please call 541-317-4200 for assistance.

Summit Health believes strongly in doing our part to reduce paper waste. In addition, many patients have requested this option as it allows convenient access to statements as well as multiple options for paying bills.

If patients still prefer paper statements, they can opt-out and continue receiving paper bills.